Adp withholding calculator

Withholding info click Federal. Just enter the wages tax withholdings and other information required.

29 Free Payroll Templates Payroll Template Invoice Template Payroll

The calculator on this page uses the percentage method which calculates tax withholding.

. Get 3 Months Free Payroll. 2 Click Edit Withholding. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

For instance a paycheck calculator can calculate your. The aggregate method is more. Get Started With ADP Payroll.

Ad Calculate Your Payroll With ADP Payroll. Just enter the wages tax withholdings and. Next divide this number from the.

Our free paycheck calculator makes it easy for you to calculate pay and withholdings. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Paystubs for all jobs.

Hourly Paycheck Calculator-By ADP. Our free salary paycheck calculator below can help you and your employees estimate their paycheck ahead of time. Use ADPs Virginia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Youre almost done be sure to include federal filing details and extra tax. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. The amount of income tax your employer withholds from your regular pay.

Process Payroll Faster Easier With ADP Payroll. Salary Paycheck Calculator No api key found Important Note on Calculator. Get Started With ADP Payroll.

For employees withholding is the amount of federal income tax withheld from your paycheck. Next divide this number from the annual salary. If you dont see the Edit Withholding button speak with your employer.

Important Note on Calculator. To help you get the most accurate. Ad Calculate Your Payroll With ADP Payroll.

Our free paycheck calculator makes it easy for you to calculate pay and withholdings. The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses. Process Payroll Faster Easier With ADP Payroll.

The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses. ADP payroll is one of the most popular choices on the market for payroll software. Process Payroll Faster Easier With ADP Payroll.

The IRS recommends that taxpayers access the online W-4 Calculator to check their payroll withholding and adjust withholding allowances if needed as early as possible. Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. A bonus paycheck tax calculator can help you find the right withholding amount for both.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Important Note on Calculator.

New York Paycheck Calculator Use ADPs New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If you have too much tax withheld. Get 3 Months Free Payroll.

3 Review the intro page. IRS tax forms. Adp withholding calculator Selasa 13 September 2022 Chinook Building 401 Fifth Ave.

What You Need Have this ready.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pin On Payroll

Hourly Paycheck Calculator Calculate Hourly Pay Adp

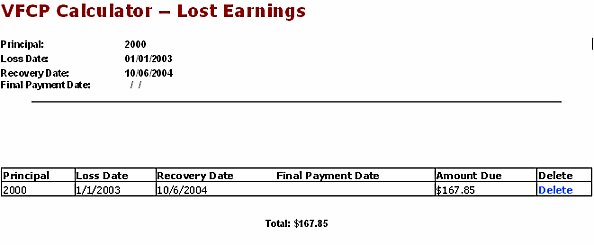

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

Hourly Paycheck Calculator Calculate Hourly Pay Adp

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

Pin On Payroll Checks

Pay Stub Preview Payroll Template Money Template Good Essay

Withholding Calculator Paycheck Salary Self Employed Inchwest

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Salary Paycheck

Teks Lesson Plan Template Best Of 62 Free Pay Stub Templates Downloads Word Excel Pdf Doc Lesson Plan Templates Teks Lesson Plans Downloadable Resume Template

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Pay Check Stub Payroll Checks Payroll Template Payroll

How To Calculate Federal Income Tax

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Hourly Paycheck Calculator Calculate Hourly Pay Adp